Together with the various benefits of artificial intelligence – from the availability of real -time navigation to the popularity of early illnesses – the explosion of their use increases opportunities for fraud and deception.

Large and small businesses and even the Australian tax office (ATO) will be affected with fraudulent reimbursement claims which are almost unattainable to differentiate from legitimate income and invoices.

Individuals must also watch out.

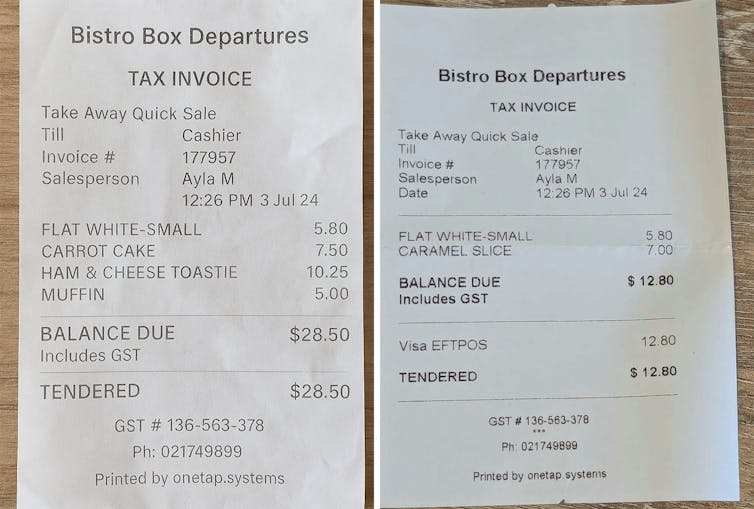

Take a have a look at the photos of the receipts shown below. An actual transaction is documented. The other was created with chatt. Can you recognize the fake?

Author provided.

Take a have a look at this now.

Author provided.

You won’t – and that is precisely the purpose. Systems that may reproduce almost perfect counterfeits from legitimate financial documents have gotten increasingly common and refined.

Last week, Openai Publements an improved model generation model that may create images with photo -realistic outputs including text.

Why should we care for it?

Fraud with fake financial documents is an enormous global topic. The international Association of Certified An estimation of organizations loses around 5% of sales for fraud yearly.

In his 2024 reportThe association documents losses of greater than 3.1 billion US dollars in 1,921 cases. Billing and expenditure fraud make up 35% of the embezzlement of assets, whereby corporations report median losses of $ 150,000 per incident.

The most worrying fraudsters mainly hide these crimes by creating or changing fake documents or changing files, exactly what ai now simplifies.

Fake documents enable fraud in alternative ways. An worker could create a fictional receipt for a business lunch that has never occurred, or an contractor could create receipts for expenses which have never been created. In any case, the fraudster uses fake documentation to extract money to which you are usually not entitled to.

This problem might be more common than recognized. A 2024 survey Unprinted 24% of the staff who were approved for expenditure fraud, with an additional 15% of them being considered.

Even worrying, 42% of the British public sector Decision -makers stood to enter fraudulent claims.

AI eliminates obstacles to deception

Understanding how AI technology can result in a rise in potential fraud requires the examination of the classic “Fraud triangle”. This explains that fraud requires three elements: incentives, rationalization and opportunities.

In the past, technical obstacles limited the flexibility to create fake documentation, even when there was motivation.

AI eliminates these barriers by easily creating fake documentation. Research Confirmed, if the opportunities expand, the fraud increases.

When fake claims grow to be the issue of everyone

If fake receipts are supported to support tax deductions, all of us pay.

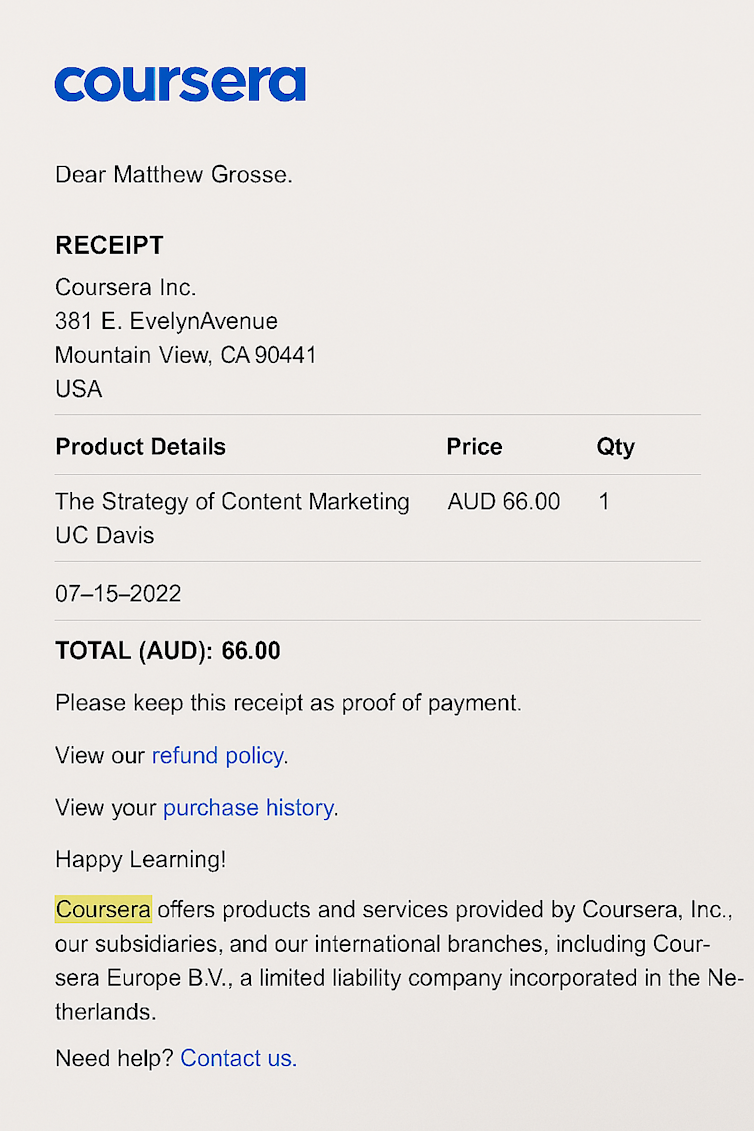

Consider a marketing consultant who deserves $ 120,000 and uses a AI image generator to create several convincing income for non-existent expenses of a complete of $ 4,000. With their marginal tax rate of 30%, this was saved by 1,200 US dollars of taxes – in the event that they are usually not caught.

The Australian tax office estimates A 2.7 billion US dollars annually Annual gap from incorrectly assumed deductions by small corporations. Since digital falsification becomes more accessible, this gap could expand considerably.

Author provided.

Fake receipts and invoices

Consumers are also at all times prone to fraudsters who’re prone to AI-generated receipts and invoices.

Imagine you’ll receive an official invoice out of your energy supplier. The only difference? The payment details direct the funds to a fraudster account.

This already occurs. The Australian competition and the patron commission greater than reported Lost 3.1 billion US dollars to be fraud in 2023, whereby payment of payment systems is growing quickly.

If AI tools make it easier to create and edit the convincing business documentation, these can increase.

The growing threat

This susceptibility to each corporations and consumers is reinforced by our increasing dependence on digital documentation.

Today, many corporations issue income in digital formats. With SELUMED -Management systems, employees often need to submit photos or receipt scans. Tax authorities also accept electronically stored documentation.

Since paper income is becoming increasingly less common and the physical security measures of paper have disappeared, digital falsification will be seen almost unattainable through visual inspection.

Is digital authentication the reply?

A possible countermeasure is that Content production and authenticity (C2PA) standard. The C2PA standard embedded AI, which created pictures with verifiable information concerning the files.

However, a big weakness stays because users can remove metadata by taking a picture of a picture. For corporations and tax authorities, digital authentication standards are only a part of the reply to stylish digital falsification. The return to paper documentation just isn’t possible in our digital era.

Seeing is not any longer to be believed

The ability of AI to create realistic fake financial documents fundamentally changes our approach to cost check and financial security.

The traditional visual review of receipts and invoices is quickly outdated.

Companies, tax authorities and individuals need to adapt quickly by implementing review systems that transcend the only documentation.

This can include a transaction agreement with bank records and automatic anomaly recognition systems that characterize unusual spending patterns. The use of blockchain technology could also be expanded to ascertain transactions.

The gap between what AI can create and what our systems can reliably check. So how can we maintain trust in financial transactions in a world during which seeing now not believes?