The Electrification boom From the Nineteen Twenties, the United States hired a century of commercial dominance and operated a worldwide economic revolution.

But before the electricity from a red-hot technology sector in faded Invisible infrastructureThe world went through profound social changeA speculative bubble, a Stock exchangeMass unemployment and a decade of world turbulence.

The understanding of this story is now essential. Artificial intelligence (AI) is analogous All -purpose technology and look up change any aspect of the economy. But it already shows among the trademarks of electricity increase, highlight and bust in the last decade, which is referred to as this Twenties.

The following billing could possibly be repeated.

First got here the ability booth

A century ago when the people on the New York stock exchange spoke concerning the latest “high -tech” taught, they talked about electricity.

Investors pour money into suppliers resembling Electrical bond & share And Commonwealth Edisonin addition to firms that use electricity in a brand new way, resembling General Electric (for devices), AT&T (telecommunications) and RCA (radio).

It wasn't one sell hard. Electricity Modern moviesPresent New magazines of faster print presses and evenings from the radio.

It was also an obvious economic player, promising automation, higher productivity and A future stuffed with free time and consumption. 1920 even the Soviet revolutionary leader Vladimir Lenin explained: “Communism is Soviet power and the electrification of the entire country.”

Today an analogous global urgency of each Communist and capitalist countries About AI, not least due to military applications.

The New York Times

Then got here the summit

Like Ai shares now, Power stocks “Favorite became within the boom, although their foundations were difficult to evaluate”.

The market power was concentrated. Big Player used complex holding structures to avoid rules and sell shares in the identical firms to the general public under different names.

US finance professor Harold BiermanHe argued that attempts to control overpriced pension stocks, a Direct trigger for the crashestimates that the provision firms made 18% of the New York stock exchange in September 1929. Within the ability supply, 80% of the market Was in possession of only a handful of durable firms.

But these are only the service programs. As today with AI there was a much larger ecosystem.

Almost every Nineteen Twenties “Megacap” (the biggest firms at the moment) owed the electrification somewhat. General Motors had, for instance Ford overhauled Use of latest electrical production techniques.

Essentially, electricity became the backdrop of the market in the identical way as AI, since firms are working on becoming “Ai-capable”.

No wonder today today Tech giant Command over a 3rd of the S&P 500 index and almost three quarters of the Nasdaq. Transformative technology not only promotes economic growth, but additionally the intense market concentration.

In order to reflect the importance of the brand new sector in 1929, Dow Jones began the last of his three major shares on average: the ability relief Dow Jones Utilities average.

But then the bust got here

The Dow Jones Utilities went average Up to 144 1929. But in 1934 it collapsed not 17.

Not a single cause explains the unprecedented “big crash” of the New York stock exchange, which began October 24, 1929 and preceded the worldwide global economic crisis.

This crash triggered a banking crisis, a loan collapse, business failures and a drastic decline in production. Unemployment rose From only 3% to 25% From US staff as much as 1933 and remained in double -digit figures until the United States entered the Second World War in 1941.

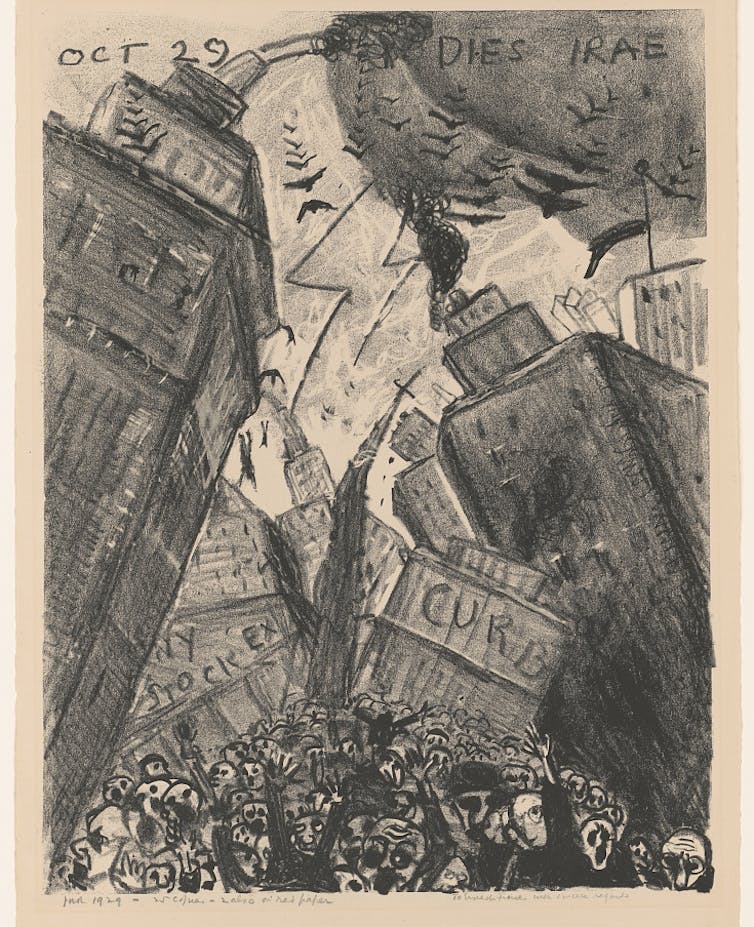

Lithograph of Wall Street, New York City, after the stock market crash from 1929. Jame Rosenberg, Ben and Beatrice Goldstein Foundation Collection, US Congress Library

The Ripple effects were global, and most countries recorded a rise in unemployment, especially in Countries that depend on international tradeLike Chile, Australia and Canada in addition to Germany.

The promised old shorter hours and electrical free time changed into soup kitchens and bread lines.

The collapse revealed fraud and excess. Electricity entrepreneur Samuel insultonce Thomas Edison'S Protegé and builder of the Commonwealth Edison in Chicago was price it in some unspecified time in the future 150 million US dollars – An much more astonishing amount presently.

But after Insull's Reich was bankrupt in 1932, he was charged Embezzlement and theft. He fled to overseas, was brought back and at last acquitted – but 600,000 shareholders and 500,000 bonds every thing lost.

However, for among the bankers, it seemed less a criminal mastermind than a scapegoat for a system, the mistakes of which ran much deeper.

Reforms that were unthinkable throughout the boom followed.

The Public utility holding company act from 1935 loosened the massive Structures of the holding company and imposed regional separation. Once, exciting stroms became boring regulated infrastructure: a undeniable fact that is reflected on the modest Square “Electric Company” on the unique 1935 monopoly Plank.

Lessons from the Nineteen Twenties for today

AI carries faster than those that need to use it for firms or state politics manage.

Like electricity a century ago, a pair Covered firms Build today's AI infrastructure.

And like a century ago, investors are stacked – although many don’t know the way high their exposure is Your superanny money Or stock exchange traded funds (ETFS).

Just like within the late Nineteen Twenties, today's regulation of the AI in lots of parts of the world remains to be a relaxed approach with its world's first AI law.

US President Donald Trump selected the alternative approach and actively shortened “stressful regulationFrom AI. Some US states have answered themselves by taking measures themselves. The dishes are through the consultation Laws And Definitions written for an additional era.

Can we go to AI that’s invisible infrastructure resembling electricity without one other bust, followed by reforms?

If the parallels to the electrification boom are unnoticed, the chances are high low.