The United States has experienced an extended time “Bullen” stock marketthat’s Rapid growth at stock prices, although this week Tech shares fell above The future prospects for the US AI.

But could the market hit a major downturn during Trump's second term within the White House? At first glance, this appears unlikely since it performs well in its first term from 2016 to 2020 (see table below). However, long -term trends on the US stock market show a pattern that indicates that the share prices might be very susceptible during its second term.

The Nobel Prize Economist, Robert ShillerWHO Studies financial markets believes that the US stock market has reached its peak and future returns might be rather more modest than in recent history, even though it doesn’t suggest that A Crash is on the horizon.

The market amongst different presidents

Shiller's data enable the connection between the president and the share prices 1925. By examining the performance of the stock market during this era, we are able to determine to what extent eight Democrats and nine Republican presidents have influenced market growth.

Changes to the share prices through the Republican President from 1925 to 2024:

Author provided (no reuse)

The table shows the share changes within the monthly share price index of Standard and Poor's share price (which specifies a snapshot of the market), which have been corrected for inflation through the term of the Republican President since January 1925.

The average increase in share prices for republican presidents was 25%. But what strikes on the map is that three principal accidents on the stock exchange amongst these official owners of the Republicans have also taken place.

The first of them, generally known as the Wall Street Crashoccurred on October 28, 1929, as Herbert Hoover Was president. This was the triggering event for the worldwide economic crisis of the Nineteen Thirties and led to a decrease of 64% on the stock exchange during its presidency.

His response to the crash (when the stock values fell dramatically) was to not do anything within the conviction that the economy would ultimately recuperate. This cost him the 1932 presidential elections as a democrat Franklin D. Roosevelt was elected for the primary time. Then, due to his New Deal guidelines, he was chosen 4 times 4 times for coping with the crisis.

The second crash occurred during Richard Nixon's term. He would have been charged by the congress if he was in August 1974 after the revelations of the Watergate scandal.

This happened when the White House began burglars to interrupt into the headquarters of the Democratic Party within the Watergate constructing in Washington DC. When Nixon's try to spy on his opponents The stock exchange fell by 47% during his term.

The third crash occurred in December 2007 when George W Bush was the president. It had its origins within the Deregulation of the financial sector that then appeared within the USA Ronald Reagan The president was 1980.

https://www.youtube.com/watch?v=5B5LZX5_EBQ

The crisis spread quickly on this planet's economic system and a recession of the Nineteen Thirties scale was only averted by quick measures by the Federal Reserve Chairman. Ben Bernankewho worked with political leaders in other countries corresponding to British Prime Minister Gordon Brown to stabilize the system. The stock exchange fell by 45%through the office of Bush.

Many aspects work to clarify this, however the overarching fact is that the Republicans are less Probably regulate the financial sector or all along the road as a democrat. Your voters are more Probably be optimistic concerning the Prospects for the economyAnd due to this fact take risks when you spend money on the stock exchange when a Republican is within the White House.

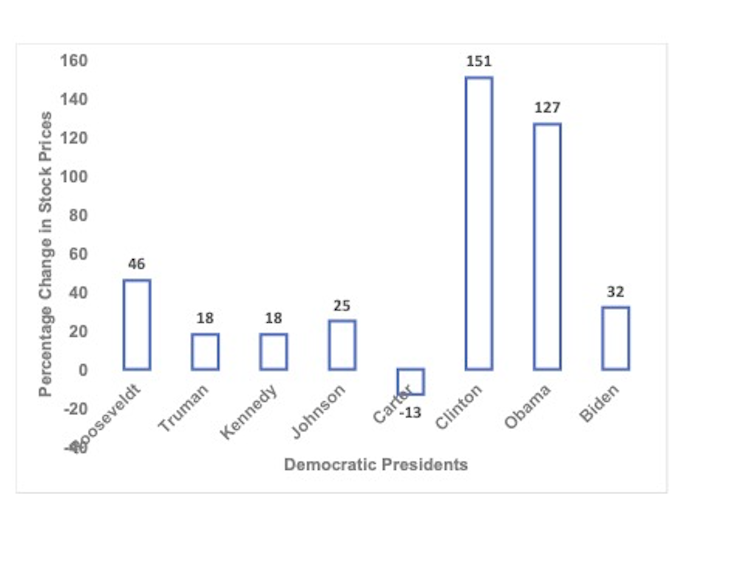

Changes to the share prices through the democratic presidents from 1925 to 2024:

Author provided (no reuse)

The second table shows changes to the share prices through the term of eight democratic presidents during this era. It differs quite a bit from the Republican diagram, since only Jimmy Carter left that president with lower stock market markets in office, and 13%.

Bill Clinton was essentially the most successful president and achieved a rise of 151%during his two terms within the White House. Overall, the stock market within the Democrats rose a mean of 51%, which is greater than twice the dimensions of the Republican.

These results are surprising since the Republicans are the normal party of great business It is also expected that it is nice for the stock market.

Donald Trump has promised to extend the tariffs for imports from the remainder of the world, especially for the world The one from China. There can be an impact Budget deficit brought on by the gap between expenses and taxation.

Most economists think These guidelines Will create inflation and slow growth.

Many investors are currently quite nervous due to a possible recession after the long bull market last 12 months. The drop in the worth of the Tech shares this week confirms this. An effect of causing A was Relief within the returns About long-term ties of US financing, reflects the fears of Further inflation.

The latest comparative examinations show that countries can have a high price for numbers Populistic economic policy. So it might be that Trump studies and falls the history of the US stock markets if he desires to avoid a serious economic downturn during his second term.