If Sam Altman from OpenAI told reporters in San Francisco earlier this 12 months that the AI sector is in a bubble, The American technology market reacted almost immediately.

Combined with the proven fact that 95 percent of AI pilot projects failTraders viewed his remark as a broader warning. Although Altman was specifically referring to non-public startups and never publicly traded giants, some appear to have interpreted this as an industry-wide assessment.

Tech billionaire Peter Thiel sold his Nvidia holdings, for instance, while American investor Michael Burry (of Fame) has made million dollar bets that corporations like Palantir and Nvidia will lose value.

What Altman's commentary really reveals will not be only the fragility of certain corporations, but in addition the deeper tendency predicted by the Prussian philosopher Karl Marx: the issue of excess capital who not find profitable sales opportunities in production.

(AP Photo/Mark Schiefelbein)

Marx's crisis theory

The way forward for AI is beyond query. Like the Internet after the dot-com crash, technology is here to remain. What it's about is where capital will flow once AI stocks stop delivering the speculative returns they’ve promised lately.

This query takes us right back to Marx's crisis evaluation driven by overaccumulation. Marx argued that an economy becomes unstable when the mass of amassed capital can not be profitably reinvested.

There is an overproduction of capital, he explained all the time when additional investments don’t generate any recent added value. If excess capital can’t be profitably absorbed through the production of products, it’s shifted to speculative markets.

Technology investments mask economic weakness

Years of low rates of interest and pandemic-era liquidity have done it swollen corporate balance sheets. Much of this liquidity has flowed into the technology sector and is concentrated within the so-called “The Magnificent Seven” – Amazon, Alphabet, Meta, Apple, Microsoft, Nvidia and Tesla. Without these corporations The market development could be negative.

(AP Photo/Manuel Balce Ceneta)

This will not be an indication of technological dynamism; It reflects capital concentrated in a narrow group of overvalued assets and functions as a function “Money that’s put into circulation in production and not using a material basis” that circulates with none basis in real economic activity.

The consequence of this is that this Fewer investments reach the “real economy”fueling economic stagnation and the fee of living crisis, each of which remain obscure formal metric of GDP.

How AI became the newest solution

The economic geographer David Harvey expands Marx's insight with the concept of ”spatial-temporal fixation“which refers to the way in which capital resolves stagnation through each temporary solutions Drive investments in the longer term or expand into recent areas.

Overaccumulation creates surpluses of labor, productive capability and money capital that can not be absorbed without loss. These surpluses are then redirected into long-term projects that move crises into recent spaces that open up recent opportunities for extraction.

The AI boom acts as each a temporal and spatial fix. As a temporal solution, it offers investors claims to future profitability which will never materialize – what Marx called “fictitious capital.” This is wealth that appears on balance sheets despite the fact that it has little basis in the true economy, which relies on the production of products.

Spatially, the expansion of information centers, chip production sites and mineral mining zones requires huge physical investments. These projects absorb capital while counting on recent territories, recent labor markets, and recent resource frontiers.

But as Altman's admission suggests, and US President Donald Trump's protectionist measures are making global trade harder, these sales opportunities are reaching their limits.

The cost of speculative capital

The consequences of overaccumulation reach far beyond corporations and investors. They are experienced socially, not abstractly. Marx explained that an overproduction of capital corresponds to an overproduction of the technique of production and the needs of life can’t be used at existing exploitation rates.

In other words, stagnating purchasing power prevents capital from being utilized at the speed at which it’s produced. Because profitability decreasesthe economy resolves the imbalance by destroying the livelihoods of employees and households whose pensions are tied to stocks.

History offers stark examples. The dot-com crash worn out retail investors and concentrated power within the surviving corporations. The The 2008 financial crisis forced thousands and thousands of individuals from their homes while financial institutions were bailed out.

Today, Large asset managers are already hedging themselves against possible turbulence. for instance has has shifted significantly towards fixed-interest securities.

Speculation drives growth

The AI bubble is primarily a symptom of structural pressures and never a purely technological event. At the start of the twentieth century, the Marxist economist Rosa Luxemburg asked questions where the ever-increasing demand for expanded reproduction would come from.

Her answer is harking back to Marx and Harvey: When production possibilities shrink, capital either shifts outwards or into speculation. The US is increasingly selecting the latter.

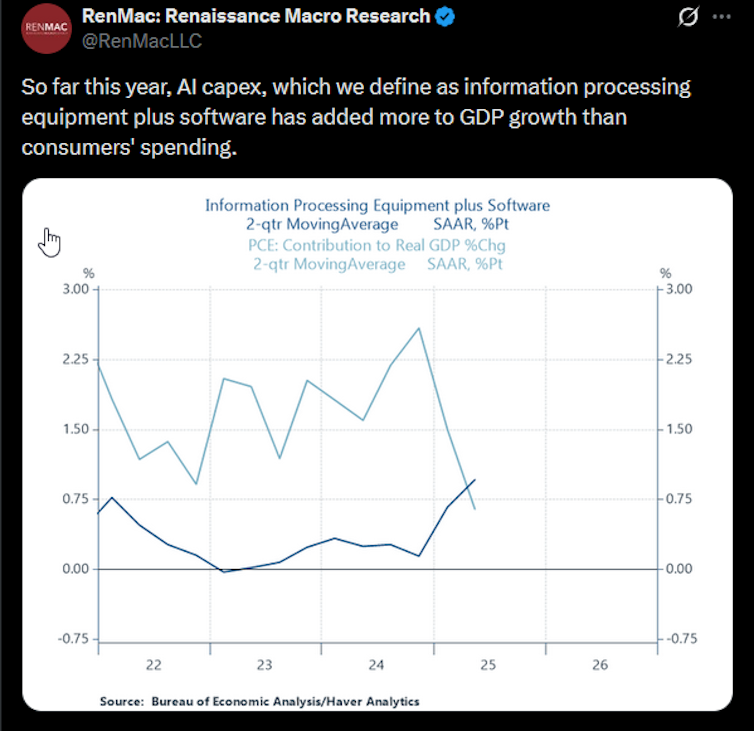

Corporate spending on AI infrastructure now contributes more to GDP growth than household consumption – an unprecedented reversal that shows how much growth is driven by speculative investment quite than productive expansion.

This dynamic is pulling downwards the speed of profit, and when the speculative flow reverses, a contraction will follow.

(X/Twitter)

Tariffs increase the pressure on capital

Financial inflation has increased as the normal pressure valves that when allowed capital to flow into recent physical or geographic markets have tightened.

Tariffs, semiconductor export controls and trade retaliation have narrowed the worldwide space available for resettlement. Since capital cannot easily escape the structural constraints of the domestic economy, it’s increasingly turning to it Financial instruments delay losses by frontloading debt or driving up asset prices; Mechanisms that ultimately increase fragility when the reckoning comes.

US Federal Reserve Chairman Jerome Powell Openness to rate of interest cuts signals a renewed turn to low-cost credit. Lower borrowing costs allow capital to cover losses and initiate recent cycles of speculation.

(AP Photo/Manuel Balce Ceneta)

Marx has this logic in his Analysis of interest-bearing capitalwhere the financing generates claims on future production “beyond what could be realized in the shape of products.”

The result’s that households are forced to achieve this Take on more debt than you may handleeffectively exchanging a crisis of stagnation for a crisis Consumer credit crisis.

Bubbles and social risk

If the AI bubble bursts, with governments having limited scope to maneuver investment internationally and economies propped up by increasingly fragile credit, the results might be severe.

Capital won’t disappear but will as an alternative be concentrated in bond markets and credit instruments bloated by a Federal Reserve anxious to lower rates of interest. This won’t avert a crisis; it simply shifts the prices downwards.

Bubbles will not be coincidences, but recurring mechanisms for absorbing excess capital. If Trump's protectionism continues to shut territorial outlets and depend on increasingly dangerous leverage as temporal solutions, the system will move toward a cycle of asset inflation, collapse, and renewed government intervention.

AI will survive, however the speculative bubble that surrounds it is an indication of a deeper structural problem – the fee of which, when finally recognized, will hit the working class hardest.