As artificial intelligence (AI) becomes more influential in the worldwide economy, one among many areas vulnerable to disruption is consumer prices. In situations where different consumers are offered the identical services or products at different prices, it’s now possible to take the liberty of selection away from employees and use a mix of historical price data, machine learning capabilities and algorithms to allocate one of the best price using a pc calculate.

Airlines like Virgin Atlantic use machine learning to, for instance, offer more competitive flight prices. (You might imagine that airfares are standardized, but they are literally influenced by quite a few variables, comparable to where you reside.) Similarly, Banks are on the way in which on this direction with mortgages.

In general, there may be the potential to alter loan prices. My research group recently published an essay Looking at auto loans in North America. By applying machine learning to hundreds of merchant credit decisions, we found that profits might have been increased by 34%.

However, this comes at a price: it will mean that riskier borrowers would should charge a bit of more for his or her loans than before. As we are going to see, there are some mitigating aspects to this, which some imagine may even justify the price. In any case, it raises urgent questions on the longer term of lending.

The transition to variable pricing

Until a couple of a long time ago, loan prices were the identical for everybody. That began to alter after the introduction of Credit scores Late Eighties. These often served to make loans barely costlier for riskier customers.

This was done partly to cover the prices incurred by creditors in pursuing defaults and writing off bad debts, and partly because customers are riskier less possible to avoid loans with stricter conditions. This means they’re less price sensitive than other borrowers – primarily because their options are more limited.

Prostock Studio

When setting prices, decisions are sometimes delegated to sellers. The best details about this practice comes from a Study 2014 In Germany, it was found that 72% of firms across multiple industries, including financial services, did so.

A classic example is the automotive loan sector. Lenders hire salespeople at automotive dealerships to set customers' loan terms, including rates of interest, deposit sizes and loan terms. For a long time, this was considered a form of accepted “best practice.” Salespeople's ability to subjectively assess customers' price sensitivity at the purpose of sale is viewed as a singular competitive advantage. And despite AI's potential to make more precise decisions using way more data, this sector has barely begun to make use of it in loan pricing.

We wanted to quantify the scale of the chance. We worked with an auto lender in Canada and used their historical data to create a statistical model to account for the critical decisions of the lender, sellers and customers. Our algorithm then estimated the influence of various loan prices on a customer's decision to just accept or reject the offered terms. From there we were capable of determine the worth that maximized profit for the lender.

Our results confirmed that customers respond otherwise to loan pricing, primarily depending on their risk profile. Although their price sensitivity may vary by country or sector, the actual fact is that that is one common phenomenon should mean that our findings are largely transferable.

What we found

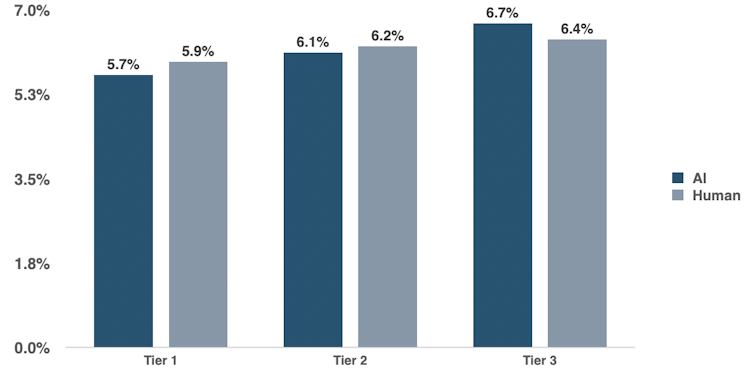

The graphic below shows how our algorithm would have re-rated the loans for our lender partner. The loans are barely cheaper for purchasers with lower and medium risk (level 1 and level 2) and costlier for the group with the very best risk (level 3). While the loans offered by sellers to Tier 3 customers were already on average about 0.5 percentage points higher than to Tier 1 customers, the algorithm calculated that merchants could charge high-risk customers 1.07 points more.

AI vs. Human Loan Setting

Author provided

This would profit the lender as it will give you the chance to gather additional interest for taking over the extra risk. At first glance, the dangerous borrower loses something, even though it isn’t as easy because it first seems.

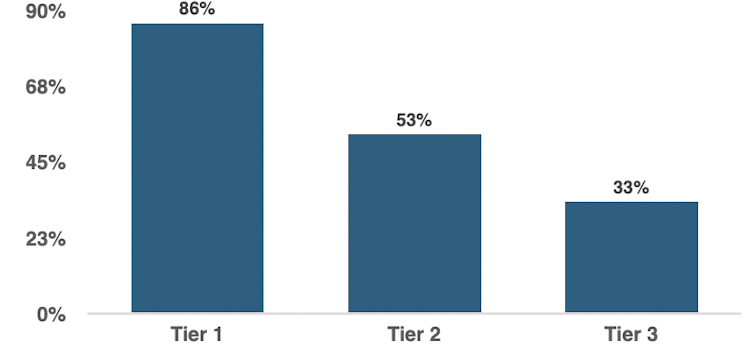

In real life, the lender's approval rate for loans to lower-risk customers was over 50 percentage points higher than to higher-risk customers. We think it’s more than likely that using an AI system for pricing would significantly increase the proportion of loan approvals for higher-risk customers as lenders can be more fully compensated for doing business with them.

Loan approval rate by risk level

Author provided

It also needs to be emphasized that the difference in loan prices increased by the AI system is small. For a three-year loan of £20,000 (C$34,338), this equates to the difference between £658 per 30 days for low-risk customers (at 12% APR) and £668 per 30 days for high-risk customers (at 13.1% APR). annual rate of interest).

What next

Based on our findings, high-quality data can replace the data that salespeople can generate on the sales floor. In such circumstances, AI-based centralized pricing is the clear winner within the race for profits.

It may be very likely that lenders will need to benefit from these recent technologies in the approaching years, regardless that they’ve already done so to slowly take over So far, machine learning for pricing decisions. In anticipation of this alteration, equity has already been raised as a problem: the UK financial regulators warned banks a while ago that they may only use AI for loans in the event that they proved that the approach didn’t drawback those that already had difficulty getting loans.

As now we have seen, high-risk borrowers can experience each advantages and downsides from this technology. As firms increasingly look to change to those models, discussions in regards to the pros and cons are only prone to intensify.